In the ever-evolving landscape of financial opportunities, the debate between Bitcoin mining and traditional investments rages on, captivating investors from novices to seasoned experts. Bitcoin, the pioneering cryptocurrency, has revolutionized how we think about money and wealth creation. Unlike the staid world of stocks, bonds, or real estate, Bitcoin mining involves powerful machines crunching complex algorithms to validate transactions on the blockchain. This process not only secures the network but also rewards miners with freshly minted Bitcoins, making it a tantalizing alternative to conventional investment strategies.

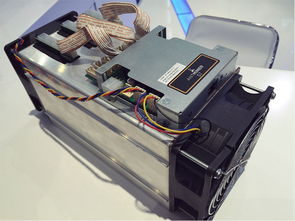

At its core, Bitcoin mining demands specialized hardware, often referred to as mining rigs, which are essentially high-powered computers designed for one purpose: solving cryptographic puzzles. These rigs, sold by companies specializing in cryptocurrency hardware, can range from modest setups to industrial-scale operations. For those without the space or expertise to run their own, mining machine hosting services offer a practical solution—your rig operates in a professional data center, managed by experts, while you reap the rewards. This setup echoes the reliability of traditional investments, yet with the thrill of digital gold rushes, where volatility can turn a modest investment into a fortune overnight.

Traditional investments, on the other hand, paint a picture of stability and predictability. Think of blue-chip stocks, government bonds, or property portfolios—these assets have underpinned economies for centuries. A stock in a reputable company might yield steady dividends, while real estate appreciates over time, shielded by market regulations and economic policies. Yet, in an era where inflation erodes savings and interest rates fluctuate wildly, the allure of these options dims. Investors often face barriers like high entry costs, lengthy holding periods, and the mercy of global events, such as recessions or geopolitical tensions, which can erode profits as quickly as they build them.

Now, let’s delve into profitability. Bitcoin mining’s potential returns are nothing short of explosive; early adopters have seen exponential gains as Bitcoin’s price soared from pennies to tens of thousands of dollars. Factors like electricity costs, machine efficiency, and network difficulty play crucial roles, but with the right setup—perhaps a state-of-the-art miner hosted in an optimized facility—the rewards can outpace traditional avenues. For instance, while a diversified stock portfolio might return 7-10% annually, a successful mining operation could yield double or triple that in a single month, especially during bull runs. However, this comes with risks: the crypto market’s infamous crashes can wipe out investments faster than a bad quarterly report.

Consider Ethereum, another heavyweight in the crypto arena, which has its own mining ecosystem. Unlike Bitcoin’s proof-of-work model, Ethereum is transitioning to proof-of-stake, yet mining rigs still play a vital role for now. This shift highlights the dynamic nature of cryptocurrencies, where adaptability means survival. Dogecoin, born as a meme, has surprised many by becoming a viable mining target, thanks to its accessible algorithms and community-driven hype. Mining farms, vast warehouses filled with rows of miners, exemplify this scale—operations that could host your machines and turn a profit through collective power. In contrast, traditional investments rarely offer such rapid pivots; a bond’s return is locked in, unswayed by viral trends or technological leaps.

Delving deeper, the costs associated with Bitcoin mining include not just the initial purchase of a miner but ongoing expenses like electricity and cooling. Companies offering mining machine hosting alleviate these burdens by providing energy-efficient facilities, often in regions with cheap power, such as Iceland or parts of the U.S. This model democratizes access, allowing everyday investors to compete with large-scale mining farms without the overhead. Traditional investments, while less technically demanding, require brokerage fees, taxes, and sometimes professional advice, which can nibble away at profits over time. Yet, the predictability of, say, a savings account contrasts sharply with mining’s gamble on block rewards and market prices.

Exchanges play a pivotal role in both worlds, serving as gateways for trading mined Bitcoins or liquidating traditional assets. Platforms like Binance or Coinbase facilitate the conversion of mining rewards into fiat currency, bridging the gap between volatile cryptos and stable investments. Here, burstiness emerges in market behavior—Bitcoin’s price can spike unpredictably due to tweets from influencers or regulatory news, whereas stock exchanges move with more measured rhythms, influenced by earnings reports and economic data. This unpredictability adds a layer of excitement to mining, but it demands a stomach for risk that not all investors possess.

To quantify profitability, let’s crunch some numbers. Suppose you invest $10,000 in a high-efficiency miner and host it professionally; with current Bitcoin prices hovering around $60,000, daily rewards could net you several hundred dollars after costs. Over a year, that’s potentially tens of thousands in profits, minus expenses. Compare that to a $10,000 investment in a S&P 500 index fund, which might grow to $11,000 with average returns—solid, but hardly revolutionary. Of course, this isn’t guaranteed; mining difficulty increases over time, and energy costs can soar, making it a high-stakes game. Traditional investments shine in diversification, spreading risk across assets like bonds or commodities, a strategy less feasible in the crypto realm where correlation between coins like ETH and DOGE can amplify losses.

In wrapping up this exploration, the choice between Bitcoin mining and traditional investments hinges on your appetite for adventure versus assurance. For those drawn to innovation, with access to reliable mining rigs and hosting services, the crypto path offers unparalleled potential—think of it as planting seeds in fertile, unpredictable soil. Traditional options, conversely, provide the comfort of well-trodden paths, steady but seldom spectacular. Ultimately, a balanced approach might be wisest, blending the best of both worlds for a portfolio that’s as dynamic as it is secure.