The allure of cryptocurrency mining, particularly the siren song of Bitcoin, Ethereum, and even Dogecoin, continues to captivate individuals seeking passive income and a stake in the decentralized future. However, the reality of mining often involves a substantial upfront investment in hardware, relentless energy consumption, and the ever-present threat of diminishing returns. The key to sustained profitability lies in optimizing energy efficiency – extracting the maximum hash rate (computing power) from the fewest watts.

This quest for efficiency leads us to explore the realm of low-power mining machines. These aren’t the hulking, power-hungry behemoths typically associated with Bitcoin mining farms. Instead, they represent a more nuanced approach, often focusing on alternative cryptocurrencies or utilizing specialized hardware designed for optimal energy usage. Think smaller, more agile, and far less demanding on your electricity bill.

The concept is simple: reduce your operational costs by minimizing energy consumption. This makes mining viable even in regions with high electricity prices, significantly extending the lifespan of your mining venture. But choosing the right low-power mining machine requires careful consideration. What cryptocurrency are you targeting? What’s your budget? And, perhaps most importantly, what’s your tolerance for technical tinkering?

Bitcoin, the king of cryptocurrencies, presents a unique challenge. Its robust mining network demands Application-Specific Integrated Circuits (ASICs) – specialized hardware designed solely for hashing Bitcoin’s algorithm. While ASICs are incredibly powerful, they also consume a significant amount of energy. Finding a truly “low-power” Bitcoin ASIC is a relative term; focus shifts to identifying models with the best hash rate per watt ratio.

Ethereum, before its transition to Proof-of-Stake (PoS), presented more opportunities for low-power mining. Graphics Processing Units (GPUs) were the weapon of choice, offering a balance between hash rate and energy consumption. While Ethereum mining is no longer possible in the traditional sense, the GPU mining landscape has shifted to alternative cryptocurrencies that still utilize the Ethash algorithm or similar variants.

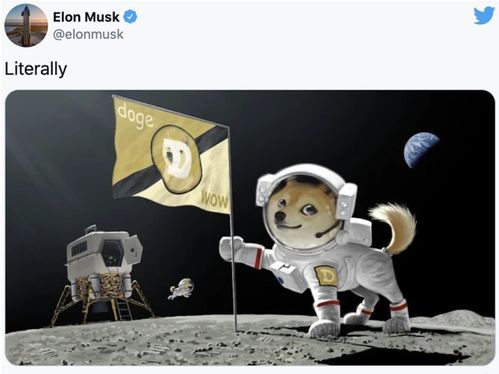

Dogecoin, the meme-turned-cryptocurrency, often provides a lower barrier to entry. Its mining algorithm, derived from Litecoin’s Scrypt, is less demanding than Bitcoin’s SHA-256. This allows for GPU mining, and even CPU mining (though highly inefficient), making it a viable option for those seeking a less power-intensive entry point into the crypto mining world.

Beyond the cryptocurrency itself, the infrastructure surrounding mining plays a crucial role. Mining farms, sprawling data centers dedicated to cryptocurrency mining, represent the large-scale, industrial approach. However, even within these farms, efficiency is paramount. Optimizing cooling systems, using renewable energy sources, and carefully selecting mining hardware are all critical factors in maximizing profitability.

For individuals, the alternative is often hosting – entrusting your mining machine to a third-party facility that provides the necessary infrastructure, including power, cooling, and internet connectivity. Hosting allows you to bypass the logistical challenges of setting up and maintaining your own mining operation, but it’s crucial to research and select a reputable provider with competitive rates and reliable service.

The choice of mining rig is paramount. Consider factors like hash rate, power consumption, initial cost, and the cryptocurrency you intend to mine. Research reviews, compare specifications, and factor in potential maintenance costs. Remember, the cheapest option isn’t always the most profitable in the long run.

In conclusion, maximizing profit with minimal energy in the crypto mining world requires a strategic approach. Understanding the nuances of different cryptocurrencies, carefully selecting low-power mining machines, and optimizing infrastructure (whether through self-hosting or a third-party provider) are all essential ingredients for success. The landscape is constantly evolving, so staying informed and adapting to changing market conditions is crucial for long-term profitability.